Expanding crypto adoption requires less complexity and easier to use products for the average person.

Problem

With the advent of Proof-of-Stake (PoS), a new yield based financial product is created. Instead of trading computing power for rewards like Bitcoin, PoS offers yield (or rather anti-dilution) in the form of inflation.

A year ago at Certus One, we began thinking about how to make the user onboarding process easier. We were primarily focused on Cosmos, but it applies generally to most PoS-like protocols.

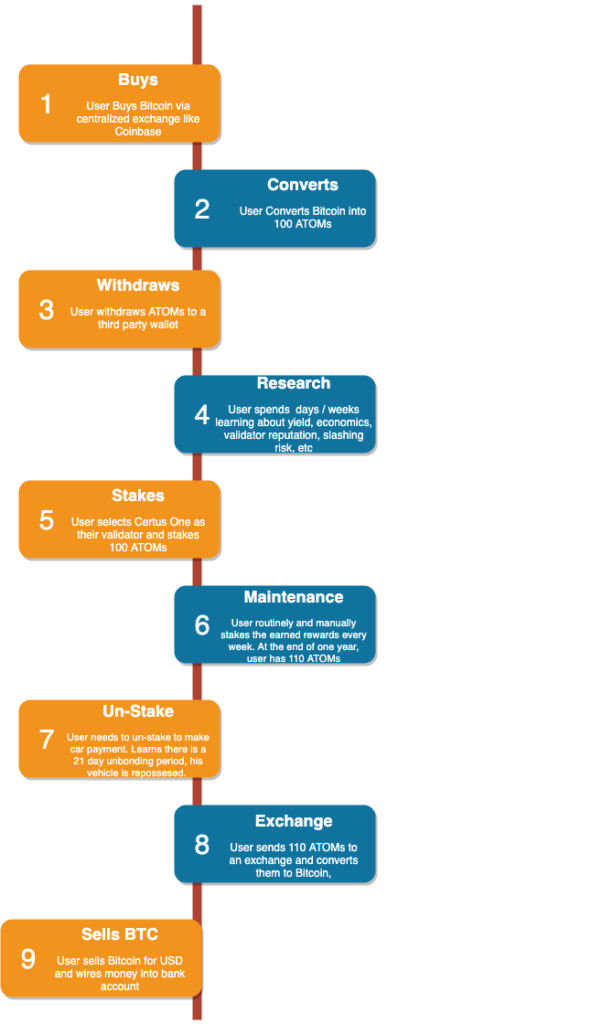

The current process is very complex and tailored towards the “intellectual elite.” Here is what the typical user flow looks like:

I am willing to bet less than 5% of people who hold crypto are able to fully complete this journey. Even top VC funds and investors are finding this difficult and have security and legal challenges over storage, for example what if the wallet has a bug like Parity’s?

For the average person, this is far too complex. The simple act of buying Bitcoin and storing it in a centralized exchange (with lots of support) would be an easy solution for the majority of users.

A comparison in the traditional world would be equivalent to buying Vanguard ETFs on E-Trade vs. buying Jun 2020 options on S&P 500 futures on Interactive Brokers.

Currently some exchanges provide yield for staking, which is awesome but the downside is that it poses risks to the networks. (more on this in separate article)

Solution

A potential simple and elegant solution – fully fungible staking tokens.

The purpose of this token is to make the user experience 10 times better while maintaining (or enhancing) network security.

Please keep in mind this article’s purpose is not to create an exact structure, but to present ideas on how such a system could be architected.

Let’s start with 3 high-level goals:

1. Make the user experience as easy as possible – reducing friction and time

2. Maintain network security and robust governance structure

3. Map out all potential edge cases and attack vectors

Key Token Properties

To illustrate, imagine there is a hypothetical asset called sATOMS (Staked ATOMs) and that smart contracts are working as they would on Ethereum:

- There is a 1:1 conversion meaning it’s fully backed by ATOMs (at its core, it’s a derivative for all you finance nerds).

- If you hold sATOMS in your wallet, you will automatically accumulate more sATOMs at a set interval (per set time or block interval for example).

- The yield would have to take into account security (validator fees), so the yield would be less than if you staked it to a 0% commission validator. The risk profile would be substantially less in this scenario (more on this below).

- You can convert your sATOMs into normal ATOMs (conditions apply).

To create such a system would require fundamental architecture design and an interesting governance structure.

Simple User Flow

- User sends one ATOM to a smart contract.

- The smart contract bonds the ATOM to a whitelist validator set.

- Smart contract issues user one sATOM.

- User accumulates more sATOMs automatically while holding said sATOMs through the staking process.

- The user can then freely trade or transfer sATOMs, just like normal ATOMs.

On the surface it is very easy and this is the overall design goal. Arguably if such an asset like this existed, it could default to the the base trading pair. For example, instead of BTC-ATOM the base trading pair on exchanges could be BTC-sATOM – this applies to sTEZ, sETH etc. Most users wouldn’t even need to send their ATOMs to the smart contract because they will buy the sATOMs directly from the exchange.

It could make a majority of the use cases of the base tokens useless – maybe just paying for gas fees?

How can this be done?

Architectural Idea

- Create a white list of the top validators (for example 20). They must pass certain requirements to participate (security, legal, insurance etc.) which is done via a governance council.

- These 20 validators set their commission rate to a standard rate like 5%.

- The smart contract selects at random (or via weighted distribution) which validator to bond to.

- Smart contract receives rewards and automatically distributes evenly to all addresses holding sATOMs minus gas fees.

- A fee is taken from the validators to be added into an insurance pool to cover any slashing or bad behavior. As the insurance pool grows, the monetary risk to the end user decreases.

This is akin to decentralization of staking rewards and risk.

This process brings to light one major challenge: unbonding periods.

Converting the sATOM/sETH/sTEZ back into ATOM/ETH/TEZ has its own set of difficulties because of the unbonding periods, which are lengths of time that the staked tokens must be held before being sold or transferred.

How can one convert a large amount of sATOM back into ATOM while circumventing the 21 day period? It could be as easy as keeping the unbonding period as it currently is.

Or, a floating liquidity pool mechanism can be put in place. For example, 1% of all ATOMs sent to staking contract is kept in ATOM form to deal with back conversions. The exact percentage would be set by the governance council mentioned above.

Potential Issues

- Users must use Atom (or ETH, Tez, DOT, etc) to pay gas fees for sATOM transfers, similar to the approach used by Gnosis where sATOMs can be used to pay gas fees.

- A validator changes their fees and does not adhere to the 5% commission structure. The smart contract would check if the commission is 5% and decide not to delegate while simultaneously unbonding all tokens and penalizing the validator.

- Some protocols like Tezos require changes in the core protocol to make a system like this work.

I would assume with such a system working flawlessly, the percentage of staked tokens in a network could reach 95% or higher.

Vision

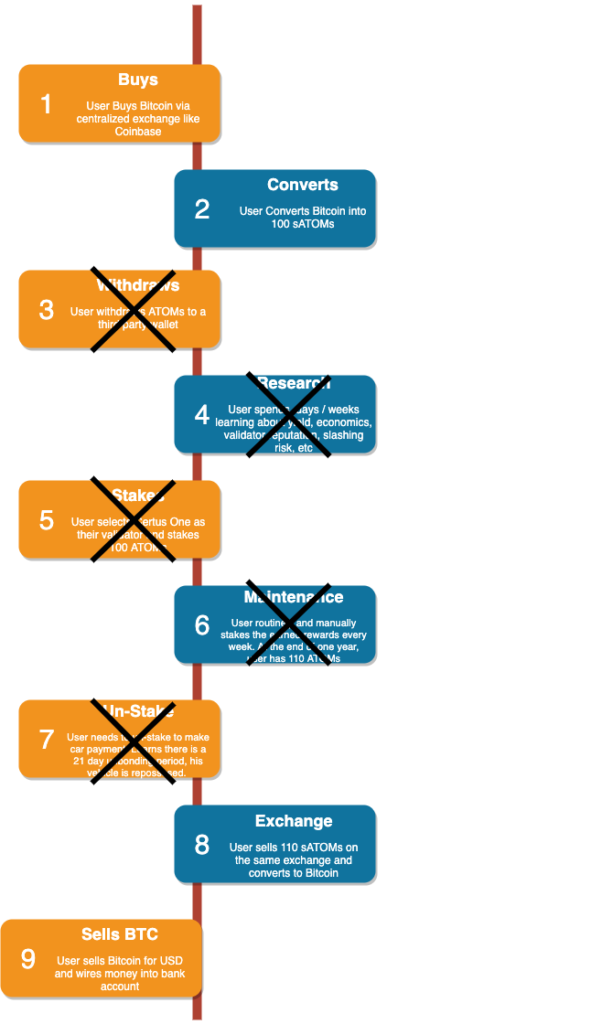

Here is the same user flow but with much of the complexity removed through the new approach:

This makes it easy enough that my boomer mother could log into Coinbase and complete this type of transaction. It’s basically as simple as buying a Vanguard Bond ETF and earning yield.

Furthermore, this creates a simplistic product to securitize to help bring in institutional money.

If you are interested in building this system, please reach out! (looking to fund). Thanks Greg Wong for working on this with me.

If you found this article useful, please share! Follow me on Twitter.