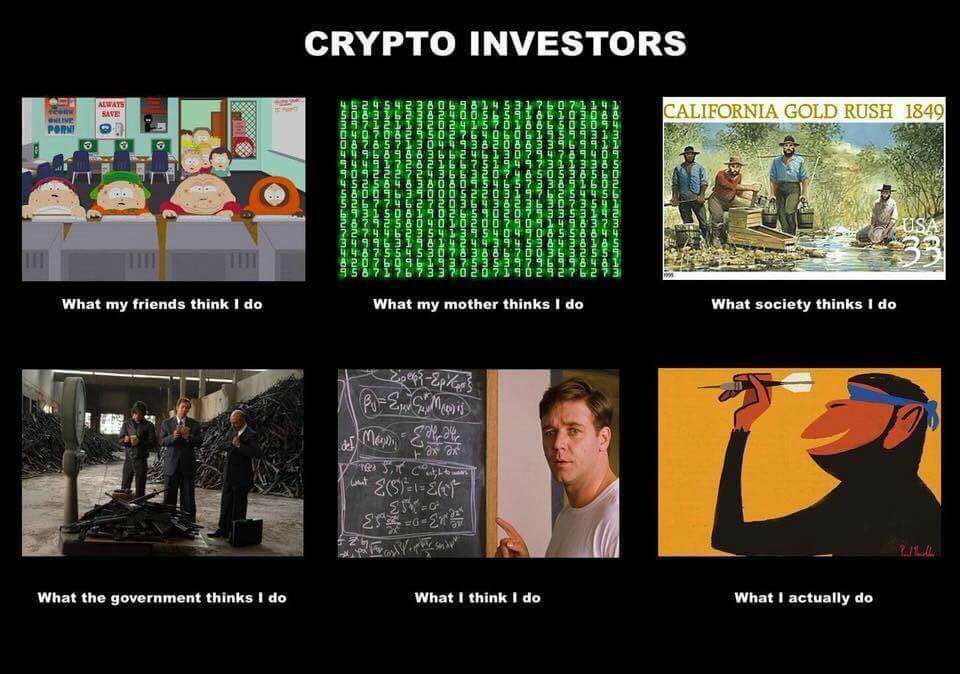

The purpose of this post is to provide a framework on the different tiers of crypto investors based on my own personal experiences from the last decade.

Introduction levels

The Newbie

The “investor” heard about crypto from their friends or the media and just bought their first Bitcoin on the most common centralized exchange for between $10 – $10,000. Since they’re a newbie they store the Bitcoin on the exchange they bought it on. This investor really just wants to learn and play around with crypto, or jump on the bandwagon/follow the hype. They haven’t read any books, the Bitcoin whitepaper or any semi-technical content and are therefore generally unable to hold a deep conversation about the benefits of Bitcoin, Blockchain and Cryptocurrency broadly.

The Enthusiast

Enthusiasts have purchased crypto multiple times and enjoy diving deeper into the world of cryptocurrency. Aside from owning Bitcoin, they have also bought or explored alts such as ETH, Litecoin, XRP, etc. They’ve read at least one semi-technical work, attend meetups or join Clubhouse and try to convince their friends to get in on it. Enthusiasts may ask questions like “should I buy XRP and where is the price of XRP heading?”

The Professional Enthusiast

Moving towards the professional side of this list, the Professional Enthusiast understands the value proposition of around 5-20 different tokens. They have deep insight into a specific sector like oracles, storage, layer 2s, anonymity, regional cryptocurrencies, etc. Half of their Twitter feed is crypto related, it’s probably the reason they started using the app again. Unlike the regular enthusiast professional enthusiasts would never store their crypto on an exchange or wallet which they do not hold they keys for. They use hardware wallets and transfer to exchanges when they need to. Professional enthusiasts can go on rants about thebenefits of newer chains vs existing ones, clickbait media headlines and regulation and can easily become fearful of any negative events. A discussion in which they would thrive would be a Bitcoin vs ETH debate or Bitcoin vs Gold. At this level they hold or have tried holding a few different tokens.

Professional Level

The Adventurer

Adventurers have participated in an ICO or 2 and most likely lost money, maybe a lot. They’d be willing to participate in more depending on how many “thought leaders” are shilling it. Their portfolio is mostly Bitcoin and/or ETH but every now and then diversifies with a new alt. Adventurers dabble in trading, vowing to never do it again when they lose their shirt. Adventurers truly appreciate the beauty and value proposition of Bitcoin, and some alts. Their interests become more complex, leading them to staking and DeFi.

The Risk Taker / Maximalist

Risk takers/ maximalists have likely participated in multiple ICOs and/or private rounds, at least one DeFI yield farming project and occasionally uses DEXs like Uniswap. They track and participate in projects on Coinlist and Binance Launchpad. These investors scour Telegram groups for new but semi-established projects to invest in the public rounds. Some have dedicated themselves to a particular project’s community and become “insiders.” They are likely actively staking a portion their assets and/or getting yield off blue-chip platforms like Compound Finance.

Some risk takers discover that all coins that aren’t Bitcoin are shitcoins. Bitcoin is the best reserve asset / store of value and this is their core fundamental investment thesis.

Bitcoin Maximalists are here.

The Typical Crypto VC

Crypto VCs invest in early-stage projects generally at the private round level with the occasional seed round thrown in. They have networked their ass off to become connected in the various communities. Crypto VCs see where the ship is headed, and thus is sometimes considered a “thought leader”. As VCs they adhere to investment framework from traditional VC firms, conducting product and team diligence and investing based on track records and participation of other investors. Though this has not always proven a successful strategy, can any of them give a detailed and thoughtful explanation as to why they invested in Basecoin? The non-technical ones can’t, or barely can, tell you the difference between Dfinity, Ethereum and Polkadot.

Fanatical Levels

At this level, people tend to split into two categories.

Crypto VC Final Form

Everything from the Typical Crypto VC category stands, but with deep technical and economic expertise. This means they are willing to make bets on early stage, unknown founders and projects. Final Form Crypto VCs can see “The Matrix” but are unable to exploit it at times due to fiduciary duty, regulatory concerns, check size and/or reputation. They are well versed in token economics and token deal structuring. They play the game well and know how to make money, LOTS of it. Real thought leaders are generally found here but rarely publish content.

Or

The Degen

Degens invest in any ICO or project that they think will become “hot.” They’re constantly checking Twitter, Reddit, Telegram and Discord. If not full-time working, they spend more than half of their working hours (at a normal, non-crypto job) keeping up to date and looking for new opportunities. This means that they can have deep knowledge of a specific community, protocol or sector. They have farmed multiple DeFi projects, actively farming or have already farmed at least 2 of the following: Curve, Yearn, 1inch, Yam, Pickle, and Aave. Degens actively participate in the communities they holds tokens in. As an investor, they have a group of fellow investors to share diligence and analyze opportunities. Remaining true to their degenerate roots, Degen Investors YOLO invest or farm tokens from unknown or very early stage projects without even looking at code (because they don’t care, they only care about avoiding a security hack or rug pull). FOMO rules their decision making. When participating in ICOs, they are generally able to get into the seed/private rounds.

Crypto God Tier

Everything in Final Form and Degen Investors without the restrictions and complete YOLO mentality. An opportunist and a monk, they do not base decisions on personal emotions or FOMO. God Tier Investors understand market dynamics, hype dynamics, other investors, psychology and liquidity at an intimate level. They hold massive bags and speculates with unwavered confidence into early projects. Makes Typical Crypto VCs stand back in awe due to their confidence in investments. Imagine these investors as NEO in the matrix – watches how the game is played, then exploit. God Tier Investors have an excellent track record of picking top performing non-bluechip projects in which majority have not even heard of. Investment returns are only discussed in multipliers, “Hey John, I did 11x on this project and only 5x on that in 6 months. It took a lot of effort to offload these position due to position size. Instead, I could have seeded liquidity to this pool and used the LP tokens to do this, then swapped and seeded liquidity for this for a return of ~15x in the same time period. Damn!”

They are not in it for the money, the money is just a scorecard of their decisions. This is their game.